Posts

553

Joined

12/19/2016

Location

Wichita, KS

US

Edited Date/Time

3/9/2019 8:55am

The thread in Moto asking about trade jobs made me want to share this. I'm getting them paid off slowly, but I strongly suggest that anyone thinking of student loans to pay for college to just let this sink in:

I did graduated payments, start small and pay more as your income grows. Started out about $250 per month, now it's up to $675. I had $45,000 and my wife had $42,000. Between the two of us we are paying ~$1100.00 per month for student loans. Our house payment is $985.00... we both went to school about the same time, so we are both averaging 6.2% interest rate. Yes we've both applied for multiple refinancers, the interest rate is the same or higher. The thing that really drives me crazy is that neither of us is using our degree.

I'm a journeyman HVAC tech specializing in Building Automation. I could have just joined up as an apprentice and gotten paid to learn.

I did graduated payments, start small and pay more as your income grows. Started out about $250 per month, now it's up to $675. I had $45,000 and my wife had $42,000. Between the two of us we are paying ~$1100.00 per month for student loans. Our house payment is $985.00... we both went to school about the same time, so we are both averaging 6.2% interest rate. Yes we've both applied for multiple refinancers, the interest rate is the same or higher. The thing that really drives me crazy is that neither of us is using our degree.

I'm a journeyman HVAC tech specializing in Building Automation. I could have just joined up as an apprentice and gotten paid to learn.

I spent 2.5 years in community college, working full time while doing so, accruing no debt. Finished my bachelors in Mechanical engineering in 3 semesters at a 4 year university.

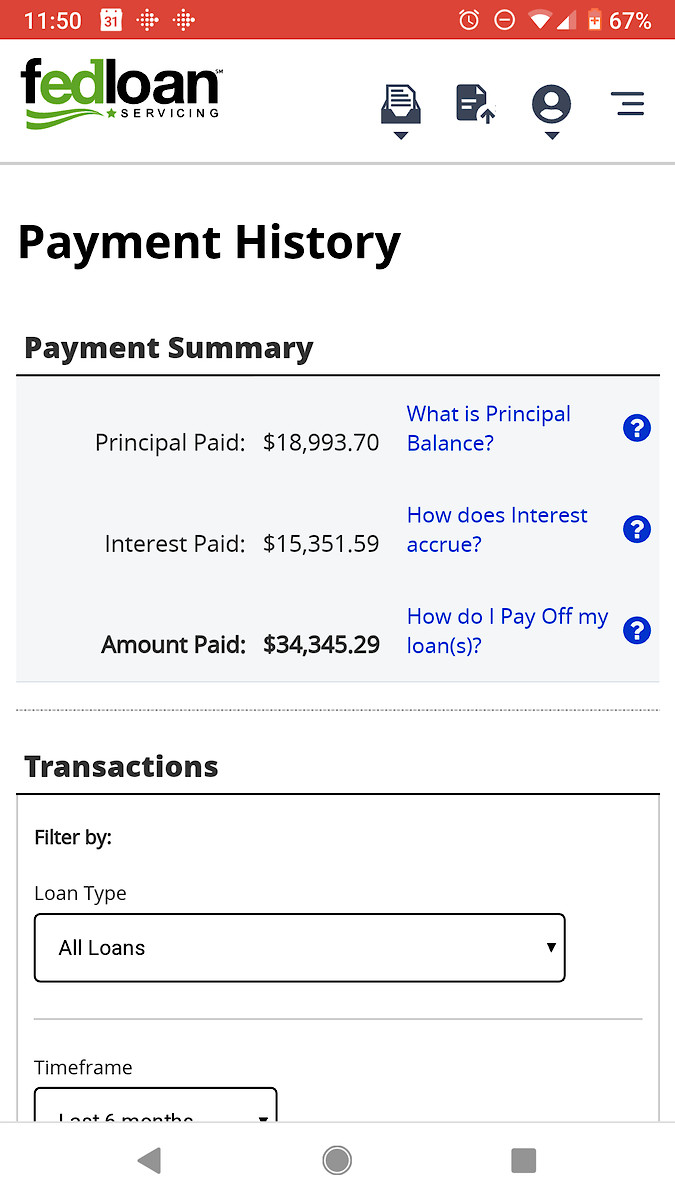

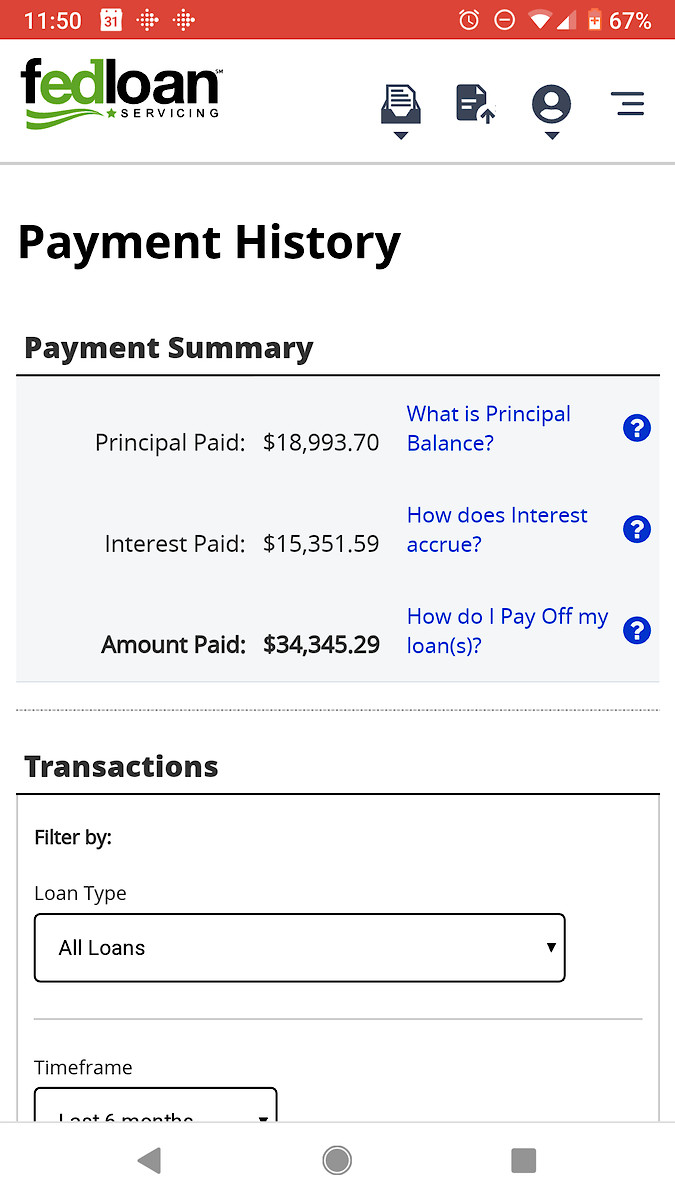

Had multiple job offers before graduating, and took the one that suited me best. The graduated payment plan from fedloans is atrocious, but atleast they're upfront if you want to know the truth in how much you'll actually pay as opposed to paying a fixed payment over a 10 year term. 6+ % must of been unsubsidized.Total amount borrowed right around 1/3rd of what you or your wife borrowed.

If you dont mind my asking, what degrees did you and your wife pursue? And what were you hoping to be able to do with them?

Smashingpumpkins- You can absolutely pay extra towards principal, I have been paying extra since I started paying back, and it makes a big difference.

The Shop

My wife started taking student loans when she first started until we got together and got married. Think she racked up about 20 or 30k which is nothing considering she's a nurse and is 6 months out from becoming a Nurse Practitioner. That's money well spent.

Instead I spent all my college time at a private university and racked up $87k in debt (finished paying it off last year), what a pain in the ass.

one loan was at 6.5% and the other was at 9.5%

problem was nobody wanted to touch them as far as refinancing them with a different lender. i've been told for 10 years that nobody will touch them because of the school i got my degree from wasn't on the short list of refinance-able loans.

fast forward to this year and i finally just bit the bullet and took out a home-equity-loan for 10 years at 5.74% and will save over $7k in interest. additionally, i'll pay them off in 89 months versus 110 months making my same $400/mo payment.

makes me fucking sick to look back at the money i've spent on student loans. what a fuckin' racket. God damn crooks.

oh... and like you, i don't use my degree

It's about keeping you in debt for life if possible.

Wondering if the Degree was worth it for those who went that route. I know several that never spent one day doing what they borrowed thousands to learn how to do.

It's the same reason a civilian 18 year old will never qualify for a motorcycle loan on his own, but they'll finance an E-2 for a 1000cc sportbike with $500 down and 18% interest. That military guy has a guaranteed job, and if the bank ever needs to collect, hell they just call the CO. That situation gets fixed real quick. The kid owes more money on that bike than he'll ever be able to get by selling it, so he's stuck paying all the interest.

Pit Row

Whoever said that they need to do a better job in high school making students understand the loan process is right. But the college ponzi scheme I'm sure would not appreciate that sort of education reaching their potential customers.

Hell, your freshman and sophomore years are basically the same shit you learned in High School over again. Completely unnecessary bullshit classes that they just want extra money in return for little to no value.

Cost of attenance 24,000! Here’s your loan. Just so happens tuition is 24,000 a year. Damn no shit.

If the government was truly worried about education they would subsidize the loans at a low interest rate. 8%+ is insane. You can’t get out.

You wanna get a liberal arts degree? Govt shouldn’t fund that. They need to fund degrees that will produce a taxpayer. Not a defaulter.

I borrow thousands to learn nothing on how to ACTUALLY do my job. Yet my job requires CONTINUING EDUCATION. Except, again, all the “continuing education” does is pull money from my pocket (and time) and doesn’t teach me anything tangible.

All my job learning is on the job. So why do we need collegiate institutions?

And I too spent/wasted a lot of money and time going to school to become a physical therapist, only to drop out and start a billboard company. I can’t quite decide if it was a total waste though, because it allowed me to mature as a person and kept me on track through my early 20’s. But I spent $30k on an “education” I’ve never used in my line of work.

Not forcing them with a gun to their head, but psychologically working them into the process.

“College debt is good debt!” Huh? I still wanna ask my guidance counselor in high school why she preached that.

Post a reply to: Student loans